- Self-Study Guided Program o Notes o Tests o Videos o Action Plan

© 2019 The Indian Express Ltd.

All Rights Reserved

The writer is the chief economic advisor with the State Bank of India.

There are currently three issues that beg answers from policymakers. First, what are the reasons for the current demand slowdown? Second, whether the current slowdown is structural or cyclical and third, whether banks have stopped lending and are causing a disruption in demand. Let us address them one by one, in the reverse order.

The slowdown in demand is a fact, but the consensus that banks are not extending enough credit to help us navigate through the current slowdown is misplaced. This is a false narrative as Economics 101 suggests a bi-directional causality between economic growth and credit off-take. Thus, a growth slowdown will percolate into a credit slowdown and not vice-versa. However, let us momentarily digress from Econ 101 and just validate whether banks are extending credit, particularly retail credit, as we are in the midst of a consumer slowdown, if we go by indicators like car sales.

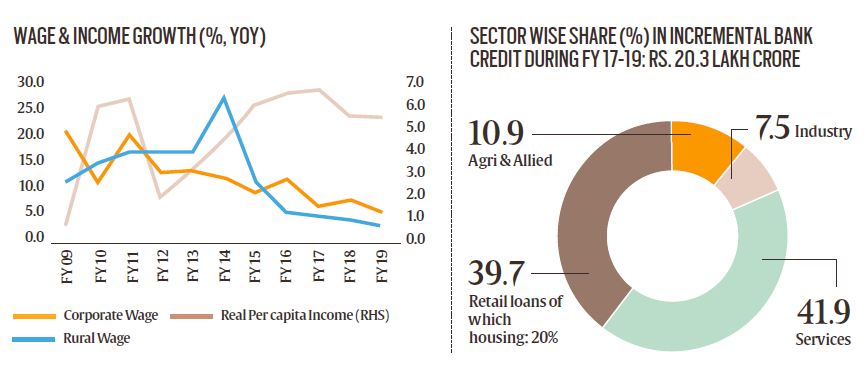

Here are the numbers. For the three year period ended FY19, incremental bank credit to the economy was at Rs 20.3 lakh crore, of which agriculture received Rs 2.3 lakh crore, services Rs 8.8 lakh crore, retail/personal received Rs 8.3 lakh crore (housing was at Rs 4.1 lakh crore) and industry got Rs 1.5 lakh crore. In the comparable period, GDP expanded by Rs 36.5 lakh crore. In Q1FY20, retail loans have continued to expand at Rs 46,000 crore (bank credit, though, has shown a de-growth of Rs 1.3 lakh crore, led by industry) even though some segments of retail loans like vehicles have indeed registered a negative growth revealing lack of demand and other cyclical issues afflicting the auto sector.

What does all this imply? Incremental bank credit doubled the pace in FY19 as compared to FY17. The slowdown in bank credit, if any, is primarily the result of credit to industry, that first declined in FY17, barely managed a positive number in FY18, but has somehow picked up pace in FY19 (ten times larger vis-à-vis FY18). This is the result of several structural reforms and disruptions, apart from deleveraging and asset quality issues beginning in FY16. It is thus foolhardy to blame bank credit for the current demand disruption. It is, rather, the lack of demand for bank credit which is causing the slowdown.

This brings us to the first and second question of the reasons behind the current demand slowdown and how to label it: Structural or cyclical or both? This labeling is important, as a structural slowdown would imply macro reforms, ignoring business cycles, while a cyclical slowdown would mean unleashing counter cyclical policies. We believe the current slowdown is a combination of both structural and cyclical.

First, what are the structural factors that might have resulted in the current demand deceleration? We believe that the most crucial factor that is reinforcing the demand slowdown is slow growth of both corporate (a proxy for urban wages) and rural wages. The corporate wage (based on financial data of 4,000 to 5,000 companies) which used to grow in high double digits (peaked at 21.4 per cent in FY09) post the crisis is now down to single digit growth, as corporates are more conscious of costs in the midst of a massive deleveraging cycle.

In a similar vein, rural wages have also declined from double digit growth rates (peaked at 27.7 per cent in FY14) growth till FY15 to less than five per cent in the last three fiscals. Clearly, this high growth phase was unsustainable (a deadly cocktail of wage-inflation nexus). However, the bottom line is the subsequent decline in wage growth and structural changes have resulted in stagnating per capita income growth (in real terms) and hence to keep the consumption expenditure at the same level, household savings also declined.

Of particular interest is the decline in household savings. Our research shows that this decline is attributed to current high real interest rate (RIR), stagnating per capita income (after touching a peak in FY17) and dependency ratio. In particular, the high RIR has two opposing effects on private savings. The first is the substitution effect, in which savings increase as consumption is postponed to the future, and the second is the wealth effect in which savers increase current consumption at the expense of saving. According to our results, the wealth effect in India dominates the substitution effect resulting in a savings decline. The higher real interest rate tends to increase the lifetime income of lenders and thereby encourages consumption and discourages savings. However, such an increase in consumption is being outstripped by other factors that are inhibiting its growth like per capita income.

Clearly, there are a host of structural factors that are holding back current consumption. A decline in wage growth resulting in lower savings is a result of conscious policy decisions to correct macro imbalances. But it has resulted in consumption taking a hit.

It is naïve to say that there are no cyclical factors. For example, to solve the NBFC crisis and the recent tax imbroglio, we need more confidence building counter-cyclical measures. In a similar vein, private investment is currently a significant laggard in total investment. The share of the private sector has declined from 50 per cent during the 2007-14 period to 30 per cent during 2015-19 in new projects investments (in value-terms). A possible increase in capacity utilisation (currently at 76.1 per cent) can happen only if we simultaneously address the sector-specific issues in order to boost demand of bank credit. One such sector is the MSME, where delayed payments of receivables for MSMEs need to be monitored. Similarly, to improve transmission in MCLR, both the asset and liability side of bank balance sheets need to move simultaneously, and that is already happening.

We must end on an optimistic note though. India can become a $5 trillion economy by FY25, based on an assumed 12 per cent nominal GDP growth and a five per cent depreciation in the rupee. Remember, China doubled its GDP in four years and quadrupled it in eight years. India remains a promising growth story — taking continuously shorter spans to add each subsequent trillion dollars of GDP. For this to continue, a coordinated policy response, both cyclical and structural, is a must.

This article first appeared in the August 14 print edition under the title ‘Reading the slowdown’. The writer is group chief economic adviser, State Bank of India. Views are personal

Download the Indian Express apps for iPhone, iPad or Android

© 2019 The Indian Express Ltd. All Rights Reserved