By Subhadip Sircar and Anirban Nag

As India’s foreign-exchange reserves march toward the unprecedented $400 billion mark, its central bank faces a costly conundrum.

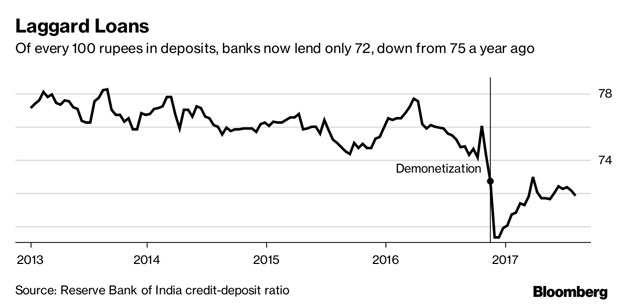

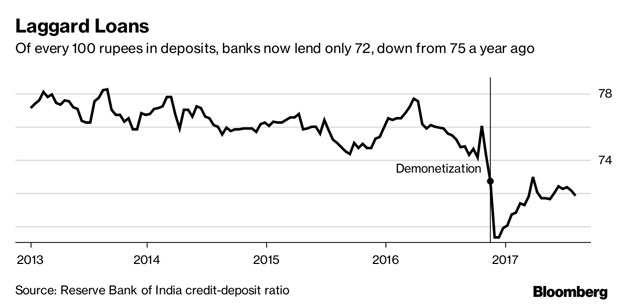

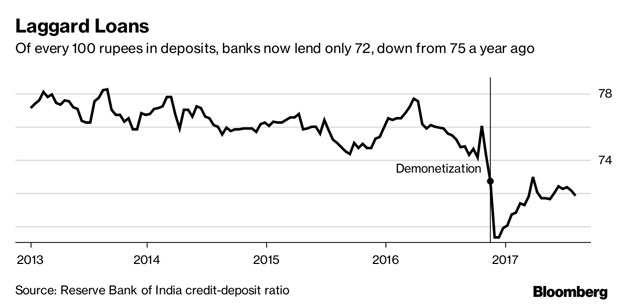

To keep the rupee stable and exports competitive, it is having to mop up inflows that’s adding cash to the local banking system. Problem is, banks are flush with money following Prime Minister Narendra Modi’s demonetization program last year, leaving them already struggling to pay interest on the deposits in an environment where loans aren’t picking up.

The resulting need to absorb both dollar- and rupee-liquidity is stretching the Reserve Bank of India’s range of tools and complicating policy. Costs to sterilize these inflows have eroded the RBI’s earnings, halving its annual

dividend to the government.

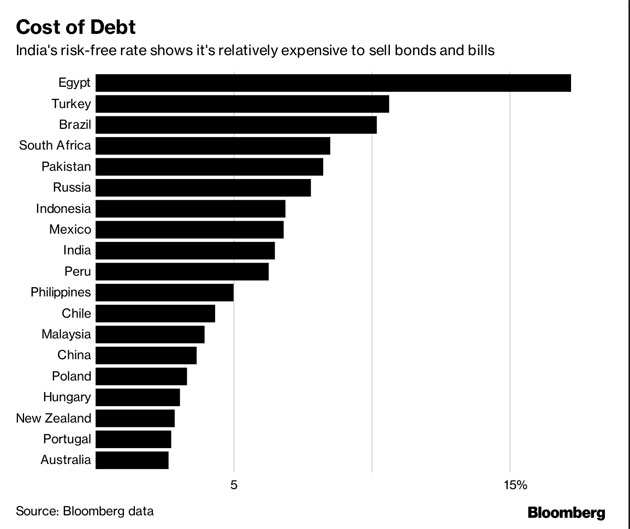

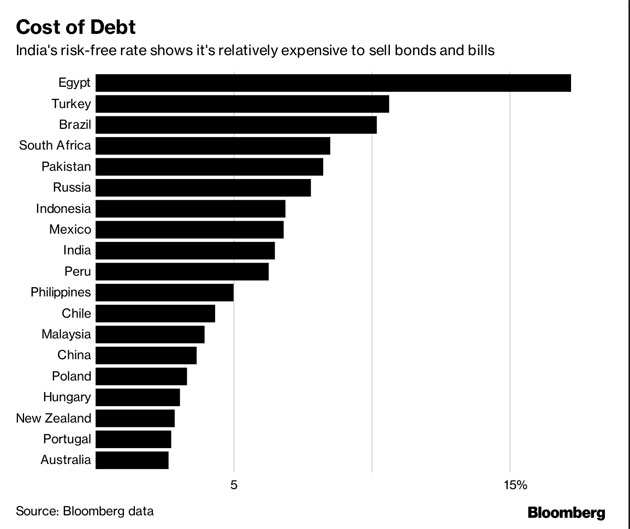

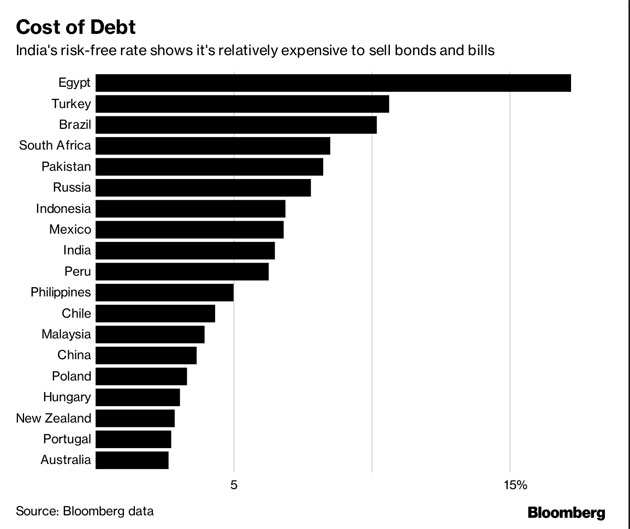

"The RBI would be paying more on its sterilization bills than it gets on its reserve assets, so it would cut into its profits," said Brad W. Setser, senior fellow at Washington-based thinktank Council on Foreign Relations. “Selling sterilization paper in a country with a relatively high nominal interest rate like India is costly."

Governor

Urjit Patel aims to revert to neutral

liquidity in the coming months from the current surplus. Lenders parked an average 2.9 trillion rupees ($45 billion) of excess cash with the central bank each day this month compared with 259 billion rupees the same time last year. This peaked at 5.5 trillion in March.

The surge in liquidity has pushed the RBI to resume open-market bond sales as well as auctions of longer duration repos besides imposing costs on the government for special instruments such as cash management bills and market stabilization scheme

bonds.

Meanwhile foreign investors have poured $18.5 billion into Indian equities and bonds in the year through June, during which period the RBI has added $23.4 billion to its reserves. Its forward dollar book has also increased to a net long position of $17.1 billion end-June from a net short $7.4 billion a year ago.

Consistent buildup in the forward book may have cost the RBI some 70 billion rupees, while total liquidity-absorption costs due to the demonetization deluge from November to June were 100 billion rupees, according to calculations by

Kotak Mahindra Bank Ltd. The RBI paid another 50 billion rupees to 70 billion rupees to print banknotes, the bank estimates. A weakening dollar would also have led to losses due to the foreign-currency cash pile, which has traditionally been dominated by the greenback.

After all these expenses, the RBI transferred 306.6 billion rupees as annual dividend to the government, compared with 749 billion rupees budgeted to come from the RBI and financial institutions. More clarity will emerge with the RBI’s annual report typically published in the final week of August.

"This disturbs the fiscal math for the year through March 2018," said Madhavi Arora, an economist at Kotak Mahindra Bank. Assuming everything else stays constant, she estimates the budget deficit may come in at 3.4 percent of

gross domestic product rather than the government’s goal of 3.2 percent.